The Payback Period Method of Investment Appraisal

The payback period is the amount of time it takes to recover the investment’s initial outlay. In other words, it is the amount of time it takes for the project to break even.

For example, if the said company invested $80,000 into an extension of its premises and it takes them five years to get back that $80,000, the payback period is 5 years. As you recover your money faster, investments with lower payback periods are preferred to those with higher payback periods.

Businesses do not want their capital invested in limited-liquidity capital assets. The longer funds are unavailable, the less opportunity a business has to utilise them for other growth-related activities. This extended duration is also problematic because it creates a riskier chance. Therefore, a corporation would prefer to receive its money as promptly as feasible.

When making capital budget decisions, one approach to emphasise this is to examine the payback period. The payback approach is limited since it only analyses the time required to recoup an investment based on predicted annual cash flows and does not account for the time value of money.

The payback period is computed based on whether annual cash flows are even or uneven. Cash flow is the amount of money that enters or leaves a firm due to its operations. A cash inflow may include money received or cost savings from capital expenditure. A cash outflow may include the money paid or increased capital investment costs. Cash flow estimates the company’s ability to pay the long-term debt, liquidity, and growth potential. Cash flows are reflected on the cash flow statement. Cash flows and nett income are distinct. On the income statement, the net income will represent all firm operations affecting revenues and expenses, regardless of the occurrence of a cash transaction.

How to Calculate the Payback Period?

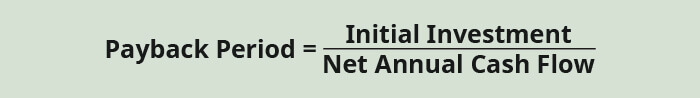

Calculating the payback period divides the investment cost by the annual cash flow. However, there is a more accurate (and slightly more complicated) way of calculating this as well:

To calculate the payback period, find out the initial investment amount and the anticipated cash flows in each time period (usually years). In the case of annual constant cash flows, simply take the up-front investment divided by annual cash flow. The cash inflows are not discounted in the simple payback period method.

Suppose you buy equipment that makes $25,000 a year after investing $100,000. The payback is 4 years ($100,000 ÷ $25,000 = 4). But, again, in most real applications, the cash flows aren’t uniform, and there needs to be a more refined calculation.

For non-even cash flows, you’ll be required to follow the running total of cash inflow until it is equal to or greater than the initial investment. Develop a running total of cash inflows for each period and determine when this running total first exceeds the initial outlay. For fractional periods, you can estimate an approximated payback period by interpolation. For example, if you’ve regained $90,000 of a $100,000 investment after 3 years, and year 4 yields $30,000, the payback period would be 3 + ($10,000 ÷ $30,000) = 3.33 years.

Also Read: What is Discounted Payback Period Method?

Disadvantages of the Payback Period Method

The Payback Period does not consider the time value of money, so it may not be the most accurate measure of an investment’s profitability. It also does not consider the cash flows after the payback period. For example, a project with a payback period of 5 years may not be as profitable as a project with a payback period of 6 years if the project with the longer payback period has higher cash flows after the payback period.