Earnings Per Share | How to Calculate EPS?

Earnings Per Share

Earnings per share (EPS) represents the proportion of a company’s nett income assigned to each outstanding share of ordinary stock.

Many financial professionals believe that EPS is the essential metric for determining the market price of a stock. Earnings per share that are high or rising can cause a stock’s price to rise. Inversely, declining earnings per share can reduce the market price of a stock.

EPS is also included in the calculation of the price-to-earnings ratio (the market price of the stock divided by its earnings per share), which is viewed by many investors as a key indicator of a company’s stock value.

Calculation of Earnings per Share (EPS)

Earnings per share is the profit earned by a corporation for each outstanding share of common stock. For EPS calculation, both the balance sheet and income statement are required. The balance sheet contains information regarding the preferred dividend rate, the total par value of the preferred stock, and the number of outstanding common shares. The income statement displays the period’s net income.

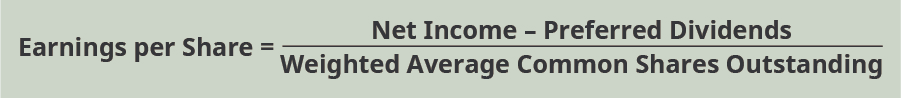

The calculation for basic earnings per share is as follows:

When preferred dividends are subtracted from net income, the denominator represents the profit accessible to common shareholders. As preferred dividends represent the net income that will be allocated to preferred shareholders, this component of the income is unavailable to common shareholders.

GAAP requires companies to calculate EPS based on a corporation’s net income, as this figure appears directly on the income statement, which must be audited for public companies.

Because EPS is a measure of earnings for each common share of stock, only common shares are utilised in the denominator when calculating earnings per share. As the firm issues and repurchases its own shares of stock throughout the year, the denominator may fluctuate. Due to this variation, the weighted average number of shares is utilised in the denominator.

ESP Calculation Example

Let’s assume ABC Limited Company earns $50,000 in net income during 2020. During the year, the company also declared a $10,000 dividend on preferred stock and a $14,000 dividend on common stock.

The company had 5,000 common shares outstanding the entire year and 2,000 preferred shares.

Earnings per share=($50,000−$10,000) / 5,000

EPS=$8.00

ABC Limited has generated $8 of earnings ($50,000 less the $10,000 of preferred dividends) for each of the 5,000 common shares of stock it has outstanding.

Factors Affecting EPS

- Net income: The more net income a company has, the higher its EPS will be.

- Number of outstanding shares: The more outstanding shares of common stock a company has, the lower its EPS will be.

- Stock options: Stock options can dilute EPS because they increase the potential number of shares outstanding.

- Share buybacks: Share buybacks can increase EPS because they reduce the number of outstanding shares.

Conclusion

EPS is a valuable tool for investors. It can be used to assess a company’s profitability, value stocks, and make investment decisions.