What are Coverage Ratios – Meaning and Calculation

A coverage ratio is a measure of relative financial exposure to a specific contingent liability. The primary purpose is to quantify the ratio of net current assets to total assets.

A coverage ratio is a common metric used in financial analysis that determines how much of a company’s assets are covered by its liabilities. This ratio can help determine whether a company is financially stable and able to meet its obligations. The coverage ratio measures the firm’s ability to service or repay the fixed liabilities. These ratios establish the relationship between fixed claims and what is normally available out of which these claims are to be paid.

These fixed claims may consist of interest on loans, dividends on preference shares, amortisation of principal or repayment of instalments of loans or redemption of preference capital. Generally, banks, financial institutions and other lenders are interested to know if the firm is financially solvent enough to repay its funds in the coming time.

This is the test of long-term solvency rather than short-term, which we cover under liquidity ratios. Loans are usually taken for a longer duration. Hence, the assessment of long-term repayment capacity and sources becomes mandatory. Following are the most popular coverage ratios:

1. Debt Service Coverage Ratio

Lenders are interested in the debt service coverage to judge the firm’s ability to pay off current interest and loan instalments.

The debt service coverage ratio is computed as below:

Earning available for total debt service (or EBIT)/ Interest Expenses+Loan Instalments

Here, earnings available for debt service = Net profit+Non-cash operating expenses (such as depreciation and amortisations) + Non-operating adjustments to income (such as gain or loss on the sale of fixed assets) + interest on debt funds

Another easy to under formula:

Cash flow from operating activities+Interest Expenses /Principal payments+Interest payments

2. Interest Coverage Ratio

It is a measure of a company’s ability to generate enough earnings to cover its interest expenses. The Interest Coverage Ratio is calculated by dividing a company’s earnings before interest and taxes (EBIT) by its interest expenses for a particular period.

The formula for Interest Coverage Ratio = Earnings Before Interest and Taxes (EBIT) / Interest Expenses

A higher Interest Coverage Ratio indicates that a company is better able to meet its interest obligations and is considered financially healthier. There will be no risk against interest-bearing expenses such as interest on loans, interest on debentures, interest on bank loans and so on. A lower ratio indicates that the company may have difficulty meeting its interest payments and may be at risk of defaulting on its debt.

Investors and analysts use the Interest Coverage Ratio to assess a company’s creditworthiness and financial health. A company with a high-interest Coverage Ratio is generally viewed as less risky and more attractive to investors, while a company with a low-interest Coverage Ratio may have difficulty accessing credit and may be seen as riskier

3. Preference Dividend Coverage Ratio

The Preference Dividend Coverage Ratio is a financial metric used to measure a company’s ability to pay dividends to its preferred shareholders. Preference shares are a type of equity with a higher claim on a company’s assets and earnings than common shares.

Preference Dividend Coverage Ratio = Profit After Tax (PAT) / Preference Dividend Liabilities

The Preference Dividend Coverage Ratio is a financial metric used to measure a company’s ability to pay dividends to its preferred shareholders. Preference shares are a type of equity with a higher claim on a company’s assets and earnings than common shares.

Investors use the preferred dividend coverage ratio to assess a company’s financial health and its ability to pay dividends. A high preferred dividend coverage ratio can also be seen as a sign that a company is well-managed and has a strong track record of profitability.

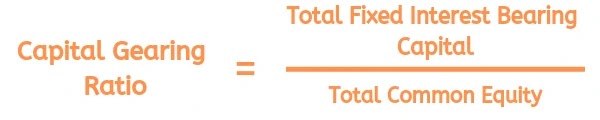

4. Capital Gearing Ratios

Capital gearing ratio, sometimes called a gearing ratio only, expresses the relationship of total internal capital to total external capital. Here, external capital refers to fixed charge-bearing securities, which also include preference shares, apart from interest-bearing bonds, debentures etc. as the business has to pay them fixed dividends. Only equity and equity funds are considered internal capital.