What is the Price Yield Relationship?

The Price Yield Relationship (also known as the price yield equation) refers to the relationship between the price of a security and its yield.

The price yield relationship is an inverse relationship between the price of a security and its yield. The higher the security price, the lower the yield, and vice versa.

In other words, as the required yield increases, the present value of the cash flow decreases; hence the price decreases. On the contrary, when the present value of the cash flow decreases, the present value of the cash flow increases; hence the price increases.

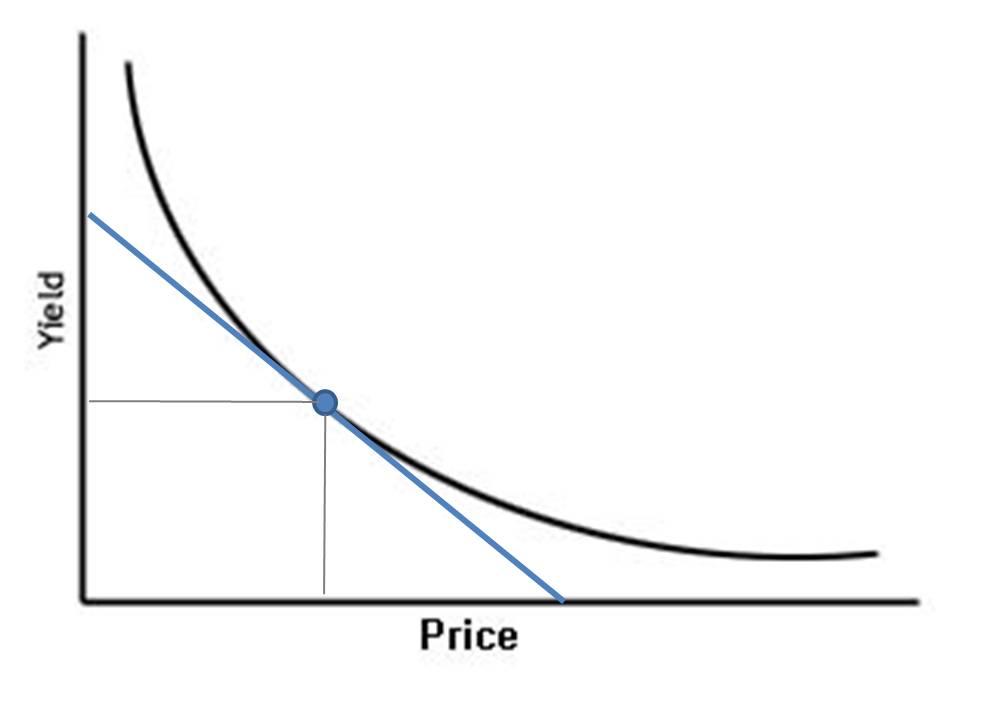

The graph of the price-yield relationship for any callable bond has a convex shape, as shown in the diagram below:

Relationship of Price and Yield

The relationship between bond price and yield can be summed up pretty simply. As the yield goes up, the price goes down. And vice versa. But why?

The government issues bonds on a reasonably regular basis. Let’s say it issues a $1,000 bond with a 5% yield. That yield looks good, so you buy a bond, hoping to hold it to maturity. Next month rolls around, and the government plans to issue more bonds. Only interest rates have risen in the past month. So it has to issue a $1,000 bond with a 6% yield. You think this is a great deal, so you try to sell that old bond to buy the new one.

Here’s where the problem lies. No one wants to pay $1,000 for a 5% bond yield when they can get a 6% bond yield for the same amount. To sell that old bond, you’d have to discount it to a lower price, yielding about 6%, to make it worthwhile to other buyers.

The opposite is also true. Let’s say you still have that 5% bond; only this time, interest rates fall, so the government issues a $1,000 bond with a 4% yield. The lower rate isn’t appealing to you, but bond buyers are pounding down your door to buy your old 5% bond. It’s in high demand, so you can charge a premium for that old bond and make a profit.